The IRS recently announced that you can contribute more pre-tax money to several retirement plans for 2022.

If you recently switched jobs or are in a different financial position than you were in 2020, now might be a great time to review your contribution amounts and make changes as needed to meet your long-term financial goals as some minor changes have been made from last year.

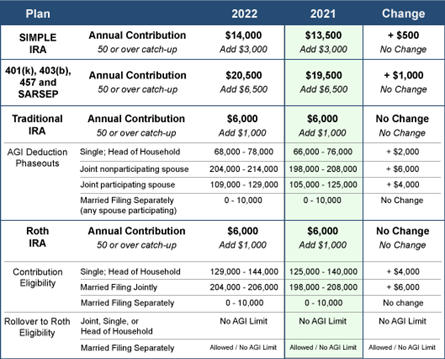

Check out the chart below for the new IRS retirement contribution limits on several popular retirement plans.

Important things to note about retirement plans:

- Limits to the employee contributions to a 401k for 2022 are now $20,500

- Don’t forget that if you are age 50 or older, you can add catch-up contribution amounts to your potential savings total

- Double check you are taking full advantage of any employee matching contributions from your employer (especially if you’ve recently switched jobs in 2021!) check with your company HR to make sure the amount you are contributing is at least up to the company match

- Setup accounts for your dependents to make sure they are taking advantage of the limits too

- Review your contributions to other tax-advantaged plans like the H.S.A. account

For more information – get booked for a call with your Booked Financial Rep

Be sure to follow our Facebook page for more guidance as it is released

This tax information is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, Booked Financial LLC recommends that you consult with a qualified tax advisor, CPA, financial planner, or investment manager. Depending on the nature of your business there are different variables that would make one option better than the other. Please understand these before choosing to deduct expenses under actual or standard mileage on your tax returns.